Black Power or Powerless? Black Elected Officials Are at All Levels in NYC but Report Finds 58% of Black Households and 65% of Latinos Live Below the Cost of Living, Unable to Afford to Live in City

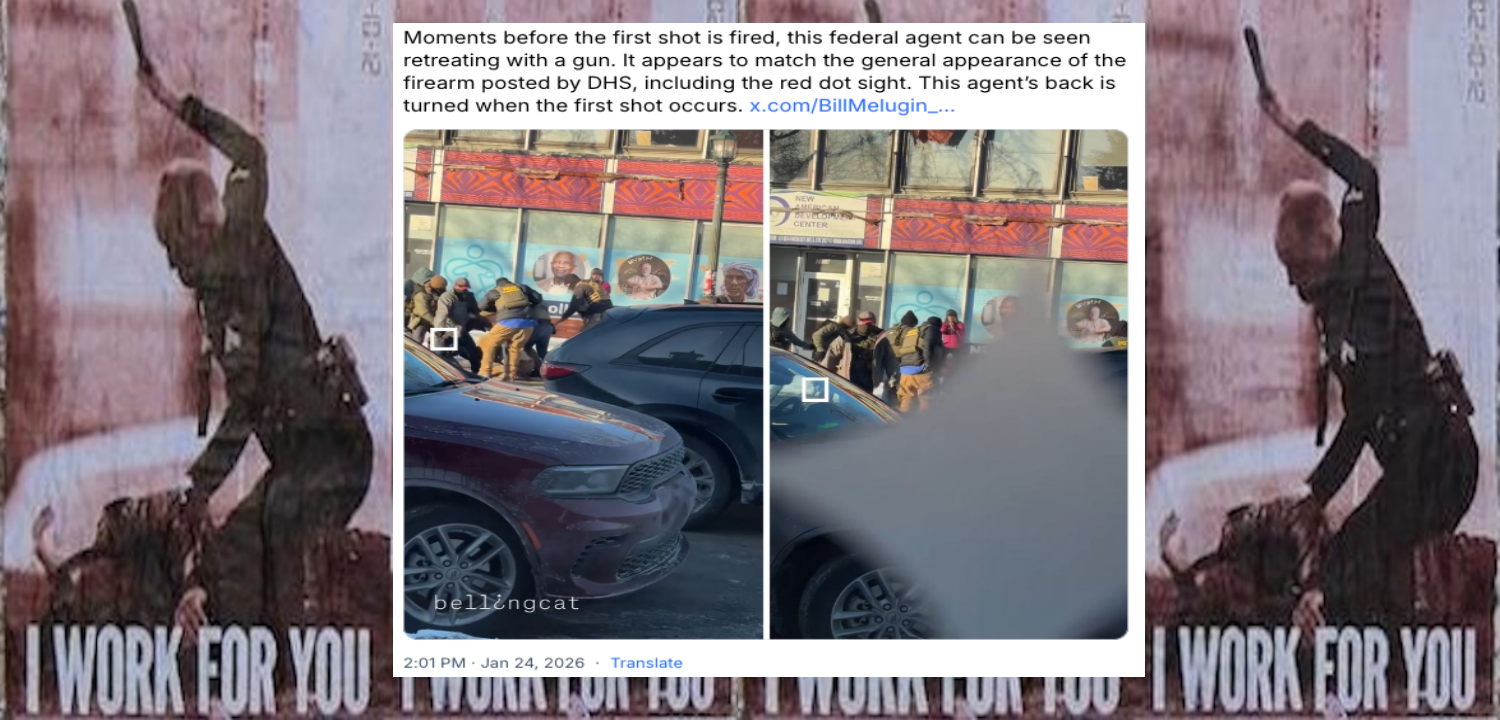

/Elected Black puppeticians and appointed strawboss authorities at all levels of government have not translated into power for Black people. Black people have no power to prevent racists from practicing racism and no power to force remedies even for the most egregious injustices. [MORE]

According to FUNKTIONARY:

BASSO – The Bait And Switch Sell-Out. The BASSO is a Neo-Negro shuffle performed by those who have bent over and touched their toes in order to be “loved” and accepted by the culture bandits. 2) the South Benders. (See: SNigger, Crossover, Criss-Crossover, Conservative Negro, Sambo, Uncle Tom-Tom, Hindlick Maneuver & Uncle Tom)

From [HERE] New York City is staring down the worst affordability crisis of the last two decades, according to a new report released on Tuesday. A full half of the city’s households did not have enough money to comfortably hold down an apartment, access sufficient food and basic health care, and get around, the report said.

The study is the latest piece of evidence to demonstrate the depth of the crisis, which is reshaping local demographics and culture in real time.

Public officials have been particularly alarmed by a significant drop in public school enrollment, which accelerated during the worst of the pandemic and is driven in part by Black families leaving the city over concerns about the cost of living. Mayor Eric Adams and Gov. Kathy Hochul have both made tackling the lack of affordability a priority, but it is unclear whether they will be able to make meaningful changes, particularly around housing.

The city is experiencing an acute shortage of affordable housing, an enormous problem that shows few signs of abating. Ms. Hochul’s push to build more housing across the state appears to have failed in recent state budget negotiations. Nearly 80 percent of households that did not bring in enough to meet the minimum cost of living in the city ended up contributing more than 30 percent of their income to housing, the study found.

The report was released Tuesday by the Fund for the City of New York, which advises government agencies and was established by the Ford Foundation in 1968, and the United Way of New York City. The reports’ authors used U.S. Census data from 2021 along with a measure that calculates the baseline for affordability for New York City families.

The study found that New Yorkers are even worse off than after the nadir of the pandemic. The groups’ 2021 report found that just over a third of city households could not keep up with the cost of living at the time, a figure that has since risen. The findings in this year’s report may partially reflect the challenges that low-income New Yorkers have faced when pandemic-era safety net programslike stimulus checks and child tax credits expired.

The percentage of households struggling to afford basic needs in the city was higher than any other year in the report’s two-decade history of studying the cost of living. Households in all five boroughs needed to be pulling in at least $100,000 to afford housing, food and transportation, and to have a shot at being able to plan for the future, the study found. In southern Manhattan, home to some of the most expensive ZIP codes in the country, families with two adults and two children needed to make at least $150,000 combined.

The actual median household income in the city was hovering around $70,000, according to the most recent Census data.

At the same time, food prices have risen steadily amid stubborn inflation, and public transportation officials have warned of looming fare hikes.

What to Know About Affordable Housing in New York

A worsening crisis. New York City is in a dire housing crunch, exacerbated by the pandemic, that has made living in the city more expensive and increasingly out of reach for many people. Here is what to know:

A longstanding shortage. While the city always seems to be building and expanding, experts say it is not fast enough to keep up with demand. Zoning restrictions, the cost of building and the ability by politicians to come up with a solution are among the barriers to increasing the supply of housing.

Rising costs. The city regulates the rents of many apartments, but more than one-third of renters in the city are still severely rent-burdened, meaning they spend more than 50 percent of their income on rent, according to city data. Property owners say higher rents are necessary for them to deal with the growing burden of taxes and rising expenses for property maintenance.

Public housing. Thousands of people are on waitlists for public housing in buildings overseen by the New York City Housing Authority. But it has been years since the city’s public housing system has received enough funds to deal with the many issues that have made it an emblem of neglect, and plummeting rent payments from residents threaten to make things worse.

The report was released Tuesday by the Fund for the City of New York, which advises government agencies and was established by the Ford Foundation in 1968, and the United Way of New York City. The reports’ authors used U.S. Census data from 2021 along with a measure that calculates the baseline for affordability for New York City families.

The study found that New Yorkers are even worse off than after the nadir of the pandemic. The groups’ 2021 report found that just over a third of city households could not keep up with the cost of living at the time, a figure that has since risen. The findings in this year’s report may partially reflect the challenges that low-income New Yorkers have faced when pandemic-era safety net programslike stimulus checks and child tax credits expired.

The percentage of households struggling to afford basic needs in the city was higher than any other year in the report’s two-decade history of studying the cost of living. Households in all five boroughs needed to be pulling in at least $100,000 to afford housing, food and transportation, and to have a shot at being able to plan for the future, the study found. In southern Manhattan, home to some of the most expensive ZIP codes in the country, families with two adults and two children needed to make at least $150,000 combined.

The actual median household income in the city was hovering around $70,000, according to the most recent Census data.