Harvard Study Finds Homeowner Disparity Between Whites & Blacks is at Its Highest in 70 Plus Years of Data

/From [HERE] Michelle Coleman has never owned a home.

Ideally, she’d like a small house with a yard for gardening and room for her children and grandchildren to visit.

She lives in a four-plex in Kansas City for $600 a month, and hers is the only one that doesn’t have a working air conditioner — a big problem in July. She doesn’t want to spend her own money to fix the air conditioner, and of course her landlord still expects her to pay her rent even though it has not been fixed.

“I’m just tired of renting,” Coleman said.

“Any extra I get, I want to put into a home, not lining someone else’s pockets.”

She’s one of a growing number of African-Americans in Kansas City — and the nation — who don’t own a home.

Across the U.S., homeownership rates appear to be stabilizing as people rebound from the 2007 recession that left millions unemployed and home values underwater, according to a report by Harvard University’s Joint Center for Housing Studies.

But the report found African-Americans aren’t sharing in the recovery, even as whites, Asian-Americans and Latinos slowly see gains in home-buying. The center said the disparity between whites and blacks is at its highest in 70-plus years of data.

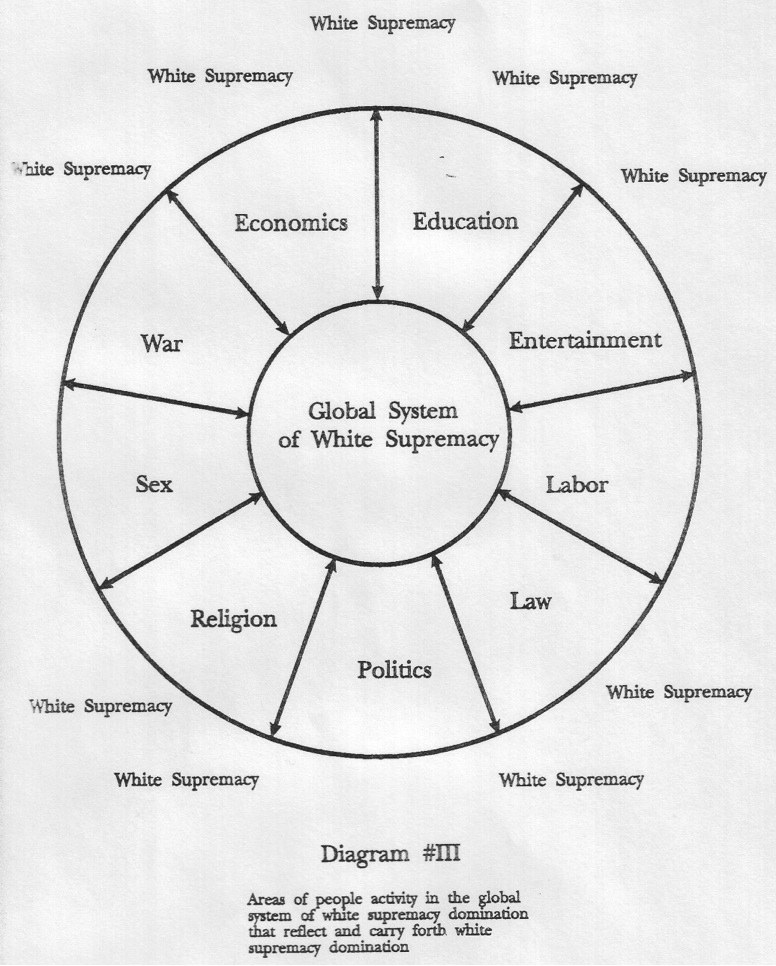

Experts say reasons for the lower homeownership rate range from historic underemployment and low wages to a recession-related foreclosure crisis that hit black communities particularly hard. This disparity is a symptom of its cause, the system of white supremacy/racism, a white over Black system of domination and vast unequal power.

Homeownership rates among African-Americans in the Kansas City metro area slipped from an estimated 45.7 percent to an estimated 37.7 percent from 2005 to 2015, according to American Community Survey data analyzed by the Associated Press.

The data show that Kansas City is among the metros with the largest decreases in African-American homeownership percentages nationwide in areas with more than 25,000 African-American households.

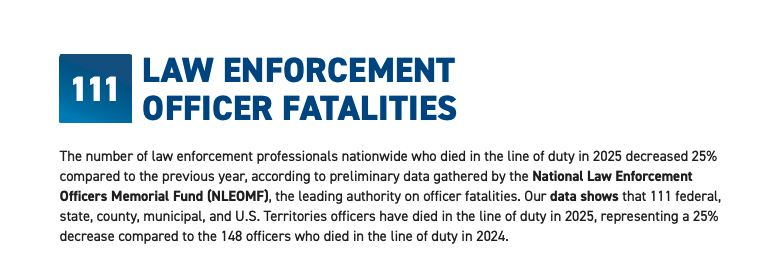

In 2004, the pinnacle of U.S. homeownership, three-quarters of whites and nearly half of blacks in the country owned homes, according to the Harvard report.

By 2016, the national African-American homeowner rate had fallen to 42.2 percent and lagged 29.7 percentage points behind whites, nearly a percentage point higher than in 2015.

Now, a lack of affordable housing and stricter lending are making it harder for first-time buyers to obtain what traditionally has been considered an essential part of the American dream and a way to build wealth.

“It has always been historically and systemically harder for blacks, and we were seeing there a little bit of progress, and now we’re back at square one,” said Alanna McCargo, co-director of the Housing Finance Policy Center at the Urban Institute, a think tank focused on urban issues that published a similar report.

Low inventory is adding to the problem. The Star reported earlier this year that the country is seeing the biggest housing inventory crunch in 20 years, according to data gathered by Trulia, a real estate listing site. Kansas City had 55.4 percent fewer homes available from 2012 to 2017.

Darryl McKenzie said he’s always rented, but he would like to own a house.

“To me, a house is the best thing to have,” he said. “But there just don’t seem to be any houses available ... and a lot of people just don’t have money to buy.”

Local housing experts point to after effects of the housing market crash that helped trigger the Great Recession in 2008, which left some racial minorities with poor credit and others wary of buying a house because of adjustable rate mortgages and other risky subprime loan products.

“A lot of minorities got into loans that were not good,” said Patricia Gilmore-Wilkins, executive director of the Greater Kansas City Housing Information Center. “They had bad loans, so a lot of them are still upside down.”

According to data from RealtyTrac, a real estate information company, pre-recession foreclosure rates were highest in the more diverse neighborhoods of Kansas City, but were still not as bad as during the recession. In 2010, the foreclosure rates in those diverse areas increased even higher, data show.

“The older I get, I keep thinking about leaving something behind for my kids,” said 46-year-old Willie Hill, an African-American Kansas Citian who said he’s always rented.

But putting together a downpayment for a house is difficult, he said. [MORE]